you find it bothering to generate a profit and loss statement every time from scratch? Well, you are on the right site! Free and downloadable templates are the perfect solution to your problem. Browse through our well-designed templates with amazing customizable features to ease your work. All you need is to fill up the fields with numbers you’ve calculated and here you go!

What is a Profit and Loss statement?

A Profit and loss statement (P&L) that is also known as an Income statement is one of the company’s financial statements that reflects the revenue and operating expenditure of a company over some time usually is a quarter or a fiscal year. The purpose of the income statement is to show management and investors whether a company has earned profit or loss during the reporting time frame. These statements are mostly defined on a cash or accrual basis.

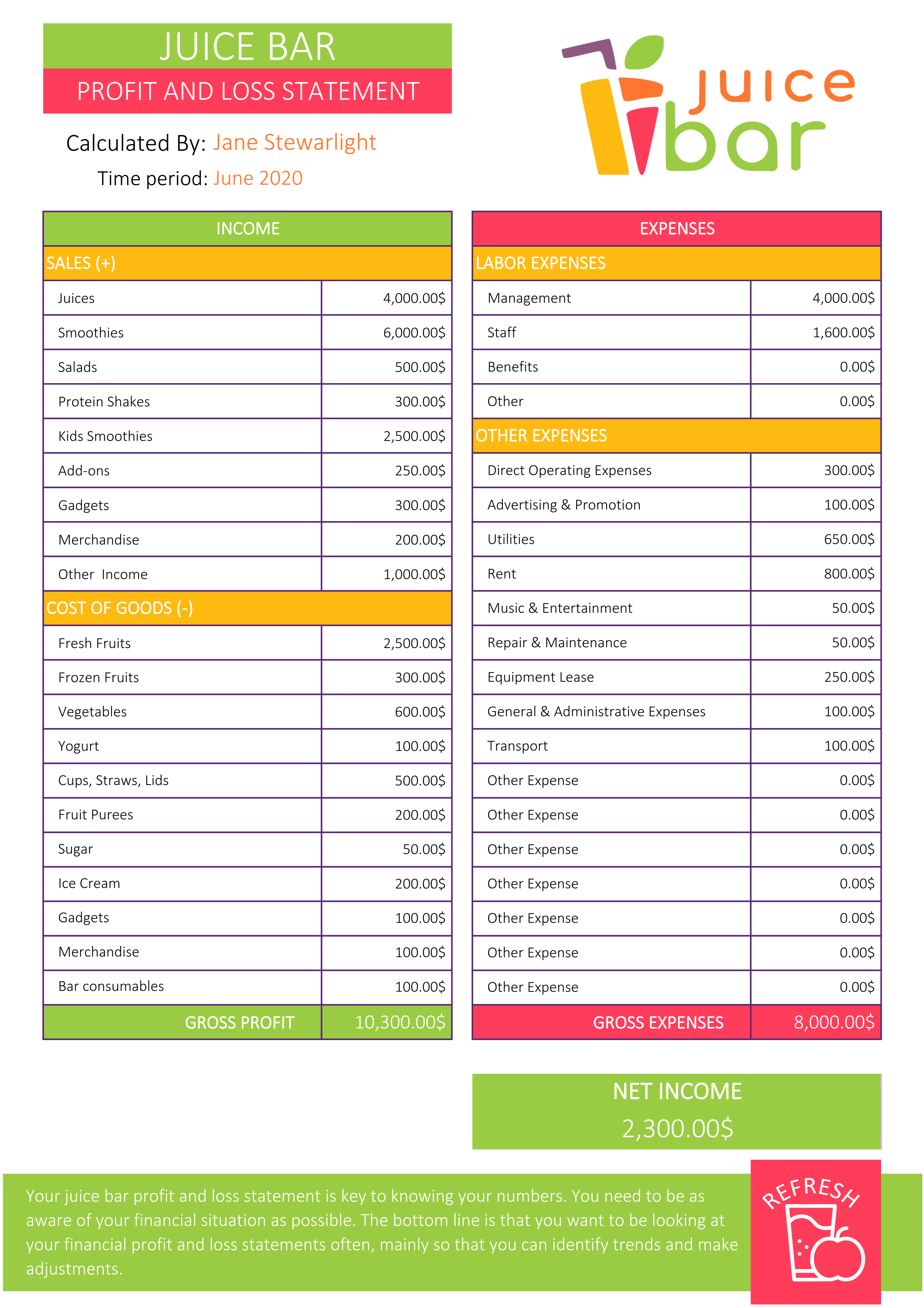

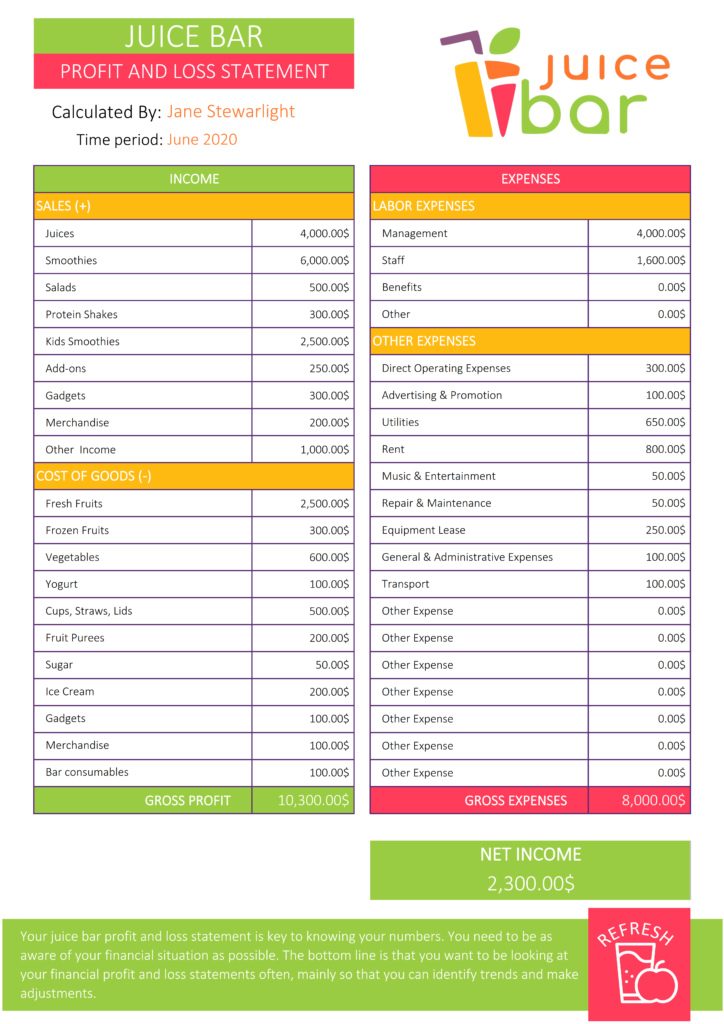

Juice Bar Profit & Loss Statement

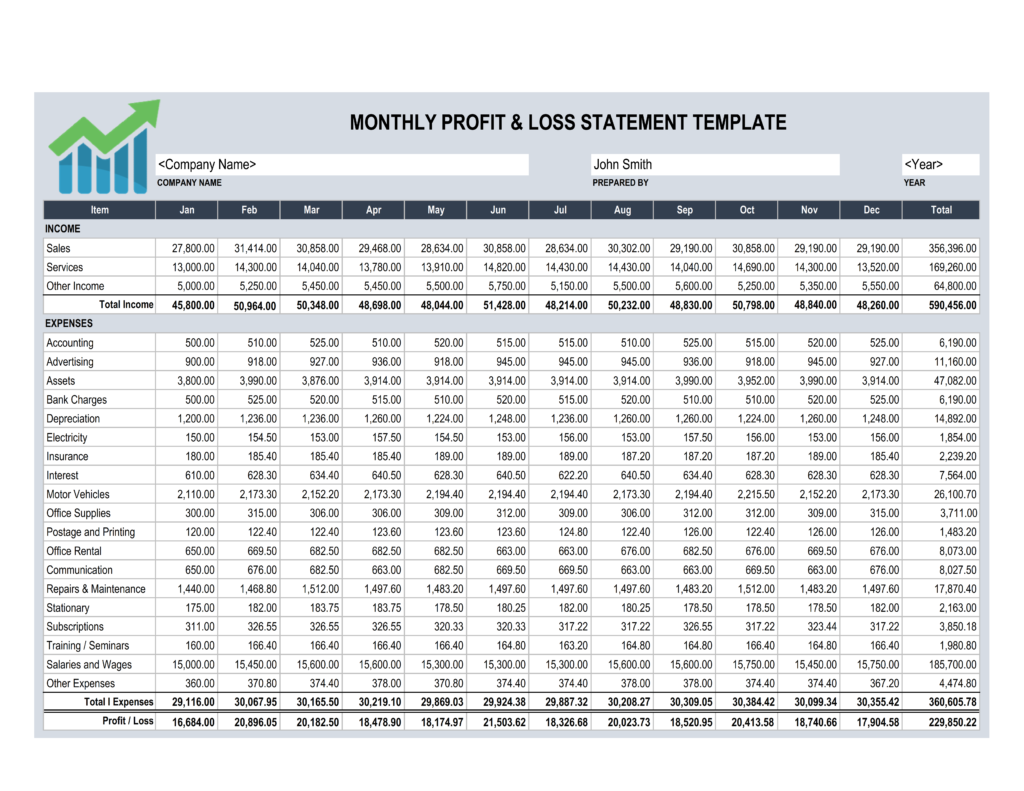

Monthly Profit & Loss Statement

Importance of P&L statement:

- The Profit and loss statement is one of three financial statements along with the cash flow statement and balance sheet that is issued by every company periodically or once a year.

- These three financial statements provide the detailed financial performance of any public company.

- P&L statement shows the soundness and earning capability of a company during some specific time.

- It is very necessary for making decisions as it gives a clear picture after increasing revenue and reducing costs, or both whether a company has been able to earn profit or not.

- A Profit and loss statement defines the top and bottom line for a company.

- It reveals the company’s realized profits or losses for the specified period by comparing total revenues to the company’s total cost and expenses.

What is the format for the Profit and Loss statement?

Profit and loss statement templates compose of the following items to ease and immediate your work:

- Revenue

- Expenses

- Income tax and Finance costs

- Advertising and Promotion

- Profit/Loss

- Gross Margin

- Revenue:

Revenue that is also known as sales income is the money that you get after selling a company’s services.

- Expenses:

An expense is the cost of operation that a company incurs to generate revenue. Accountants record an expense on a cash or accrual basis. It is further organized into two types: operating expenses and non-operating expenses. These may include Cost of Sales, Selling and Administrative Expenses, Research and development expenses.

- Income tax and Finance Cost:

The total amount of taxes liable on a corporation by a taxing authority. It is the product of taxable income and effective tax rates. Finance costs may include the interest and other money acquired by a company when borrowing debts. They are also known as “borrowing costs”.

- Advertising and Promotion:

Every company spends enormous amount of money on advertisements and promotion. In P&L you must enter advertising expenses in required field.

- Profit/Loss:

The excess of total revenue over total cost during a specific period is known as profit. Contrarily, when the total cost spent is greater than revenue earned by a company, then it suffers loss. You can calculate profit or loss by simply subtracting expenses from income, if it is positive you have earned profit and vice versa.

- Gross Margin:

Gross Margin is used to define the value of incremental sales and to guide rating and advertising decisions. It can be calculated by subtracting net sales from the cost of goods sold (CGOS) and then dividing it by revenue.

Benefits of P&L Statement:

A P&L statement helps stockholders and creditors to determine the economic performance of the company and to forecast its future performance of it. It also allows us to evaluate the proficiency of generating future cash flows using the statement of income and expenses.

Profit and loss statement formula:

It is a very simple formula that is as follows:

Net Income=Total Revenues- Total Expenses

A Profit and Loss statement simply compares the total revenue collected with expenditures in various aspects whether they are administrative or taxable expenses. It helps stakeholders of a company to quickly analyze the strength and growth of the company and even to predict performance for the time ahead based on data collected.

What does a P&L statement template offer you?

- You can choose the specific duration for which you want to develop an income statement. It could be monthly, bi-monthly, or yearly.

- You can add your net sales and expenditure i.e. Cost of Goods Sold (COGS), Depreciation, Selling, and general expenses easily.

- You can modify the statement at any time easily and efficiently. You can insert or delete rows as per your requirements.

- It allows you to double-check formulas to ensure they are working as you intended.

Steps for Using Profit and Loss Statement Templates:

Follow these steps to download and modify P&L statement templates:

- Firstly, download the template.

- According to your requirement, choose an annual or monthly sheet for the statement.

- Generate a trial balance report and calculate your revenue before customizing the template

- Type in each active cell related to the required field in excel.

- Insert or delete row to adjust template according to your requirement

- Counter-check that every formula is working as intended.

- Save a copy of the file in pdf or xls format.

You can save your work to use in the future to analyze yearly net sale changes.