We are living in the 21st century where everything is fastly moving toward evolution and development but almost ¾ of the world population still faces the financial crisis. This ratio is increasing day by day as the standard of living increases. No matter how you plan, you got entangled in the debt whether they are taken for the education of your children or business startups. An increasing interest rate has made it difficult for us to make both ends meet. You would be probably in the hassle that either you have to support your family through earning or to pay for the loans that you have taken in the past. It would be very difficult for you to persuade the money lender to postpone the due date or to decrease the interest amount.

Well, here we will provide you with a persuasive financial hardship letter template that will help you to enlist all your financial spending and tough time you are going through effectively so that your lender may pity you. You can download financial hardship letters available in word, pdf, and excel format free of cost.

What is the Financial Hardship letter?

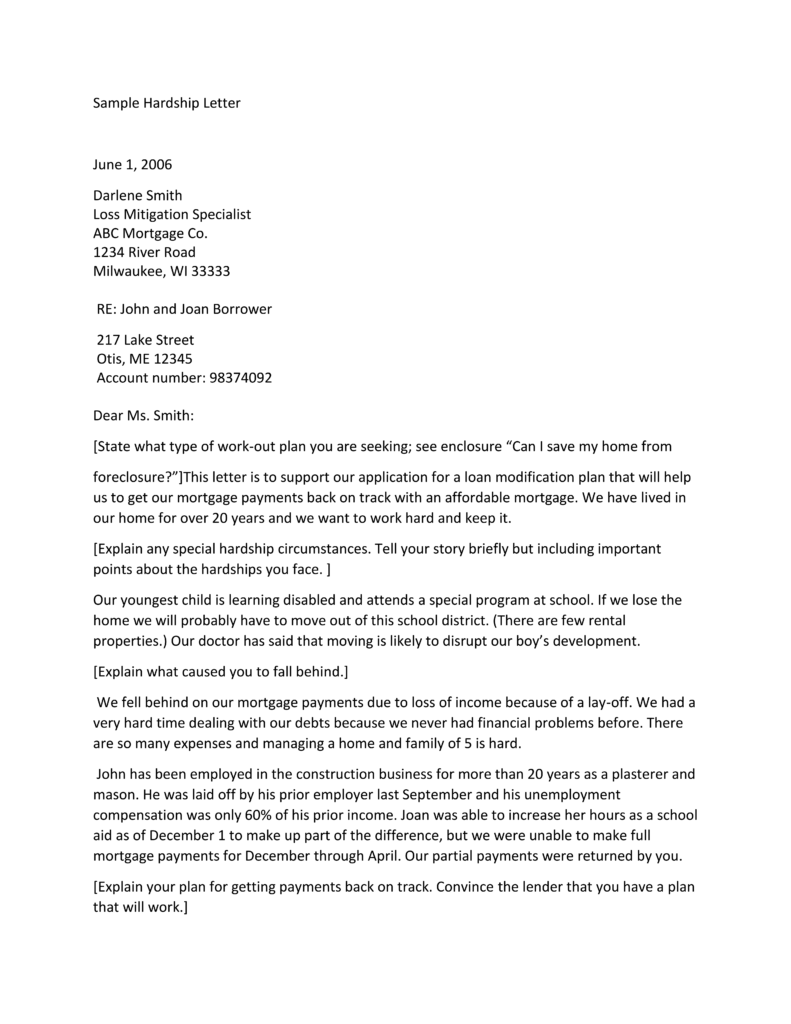

A financial hardship letter is a formal document that clearly describes financial circumstances you are going through to the lender person or financial organization like banks etc. It is usually written to imply that you are unable to pay the debt due to the financial conditions of you or your family. It demands that the lender may have pity on the borrower and urge to waive off debt or give you some privilege. It is written to persuade him by explaining the financial circumstances. An easier way to explain financial hardship letter is the letter that is requested for consideration as the person is struggling with his finances.

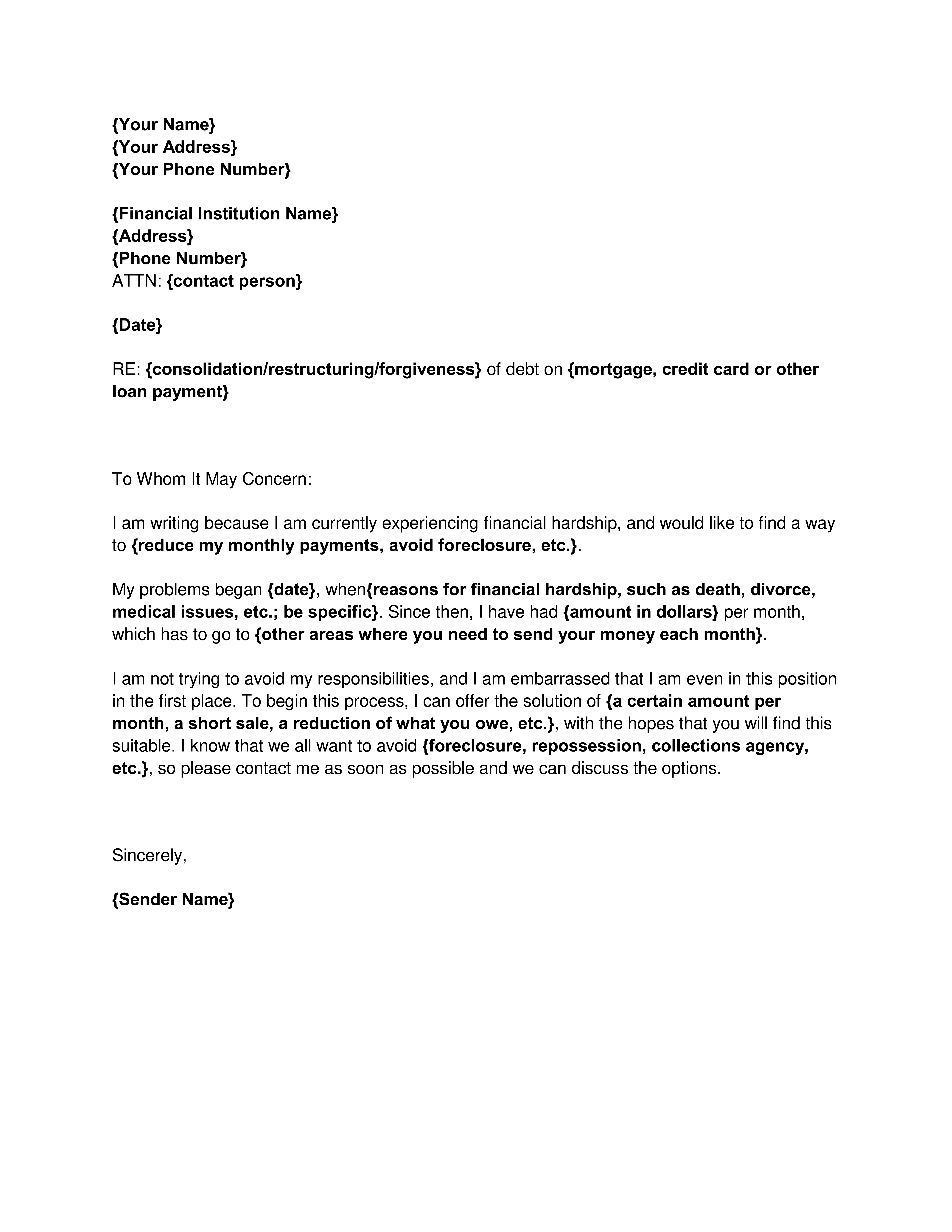

Financial Hardship Letter Template 01

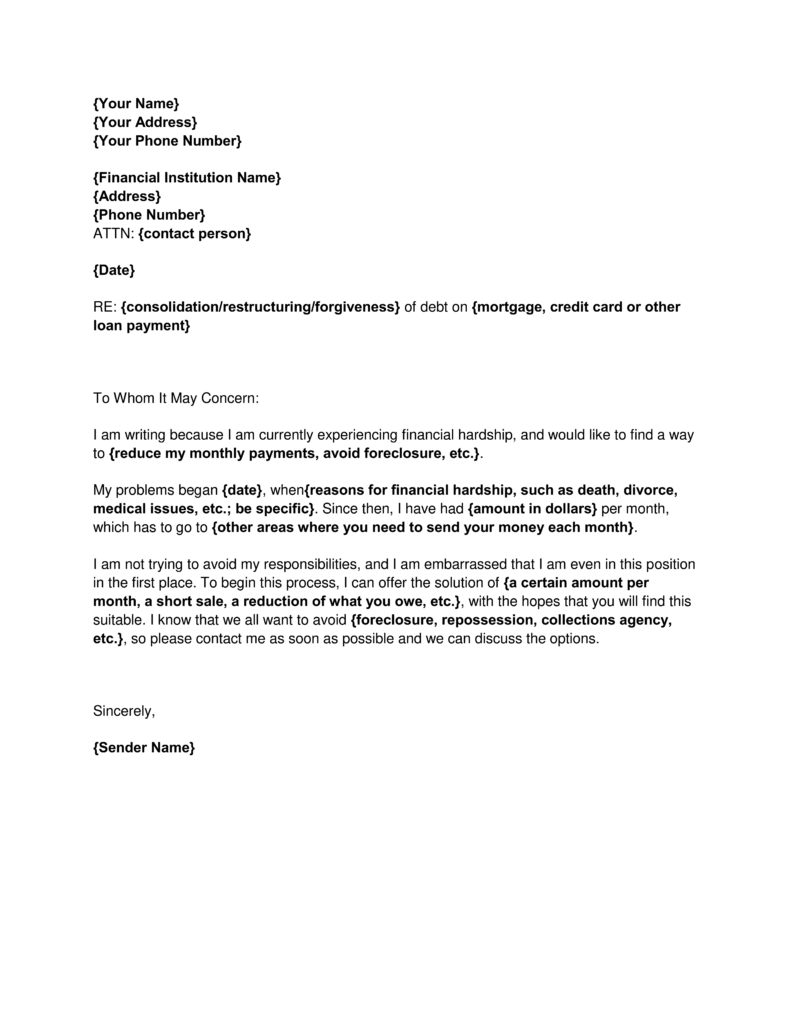

Financial Hardship Letter Template 02

What is the significance of the financial hardship letter?

A financial Hardship letter can be a ray of hope for the person who is burdened with debt and other economic crises. So it holds a lot of significance, let’s discuss some of the important points here:

- A financial Hardship letter is mainly used to attain leniency and consideration for unpaid debts and also to postpone the due date for the payment

- While you are struggling with paying the home mortgage and still want some consolidation from the lender in respect of the time, you must write a financial hardship letter to demand a temporary loan modification plan.

- In the letter template, you must mention some of the specific details like hardships are caused due to what circumstances i.e. university fee payment of your child, Sudden economic conditions throughout the country, etc. followed by them when it is expected that these circumstances will end.

- Debt Hardship letters must also include the future steps you will take to help yourself in the payment of the debts. It is the key aspect you must mention if you want that your letter is considered practicable.

- Lenders may require documentation as proof so you should add the proofs like your account statement, yearly earnings, profit and loss statement of your company, and certain other statements that will help you in this regard.

What should the financial Hardship letter compose of?

A financial hardship letter must be elaborated and well-detailed that it covers each and every aspect of the area. It must include all the necessary information because it must meet the purpose it is written.

Here are the details you need to add in the Financial Hardship letters to meets its purpose.

What is the cause of writing of financial hardship letter?

Write details about the financial hardships you are facing in the letter. Be honest while mentioning this cause. Otherwise, you may lose the trust of the lender which can worsen the situation. Provide the exact details and avoid extra information. There is no need to meddle with the figures and facts about the problems you are facing. Sometimes a borrower may think that it is an invasion of their privacy but to persuade your lender is not possible without the actual description of the crisis.

When has the crisis started?

Next mention that date when you had felt that you have encountered the financial crisis. It is another important aspect you need to mention in your financial hardship letter template. If you are writing after one month, there is no need to panic you can just write why you have taken such time for instance you can mention that you have spent time addressing this problem.

This stance might be persuasive.

What are your demands?

Most importantly mention what you want as a borrower from the lender. It can be either decrease in the debited amount or to increase in the due date for the payment of loans. The lender can act accordingly if you have a genuine reason. In that case, they may ask for proof. You must include proof beforehand to avoid further confusion.

Download financial hardship letter templates available in word, pdf, and excel format.

The Situations that are Recognized as Hardships:

Let’s discuss hardship you can mention in the debt payment hardship letter so that it is persuasive. Sometimes you mention such minor hardships that are not even recognized by the lender so keep this list in your mind before writing the financial hardship letter.

- Change in your employment status i.e. demotion or termination.

- Change in your salary income due to certain internal or external reasons of the company.

- Death of the guardian, or financial supporter.

- Retirement from the job

- Loss in the business incurred.

- Unemployment

- Increased expenses or educational expenses.

- Theft or Robbery.

- Natural disasters.

- Accident or Acute illness.

These are some of the recognized financial troubles you may encounter out of a bad fortune. You should address these problems in the letter to persuade your lender to have some pity on you and to give privileges.

Download financial hardship letter templates available in word, pdf, and excel format to accelerate the process of producing a worthy document. All you need is to download the free-of-cost template, format the document and the letter is ready to use. REMINDER: BE HONEST.