re you going to sign a family loan agreement with your relative? Wait, you will need a proper and well-designed family loan agreement templates that will help you formulate your terms and conditions. It will be the safest method because it will act as a legal document once both parties will sign it. This is a very crucial document so here we will provide you the pre-designed free and downloadable family loan agreement templates to help this cause:

What is the family loan agreement?

A loan agreement is a mutual promise between a borrower and lender to regulate a contract regarding money. A loan agreement is usually a written contract between parties. Different commercial banks and finance companies offer formal loan agreements to their clients or borrowers. However, a loan agreement between members of a family is referred to as a family loan agreement. It is usually a simple loan agreement that bounds a borrower to fulfill repayment terms and money borrowed. Usually, there is no interest amount applied on the loan.

What is the difference between a Family loan and a Bank loan?

A family loan agreement is an informal type of loan between family and friends for personal, educational, or business investment. Despite it is not an official one and follows hard and fast rules but still you need to sign a contract and repayment terms. Usually, in a family no surcharge or interest is implied but still if it is, you need to abide by the usury laws defined according to your country. You enjoy soft restrictions; the lender can postpone the returning date in case of any mishap.

A bank loan agreement is the formal type of contract between borrower and lender for various purposes. It is official so you have to sign an agreement that mentions payment terms and conditions. You have to act upon terms and conditions to avoid unfavorable circumstances.

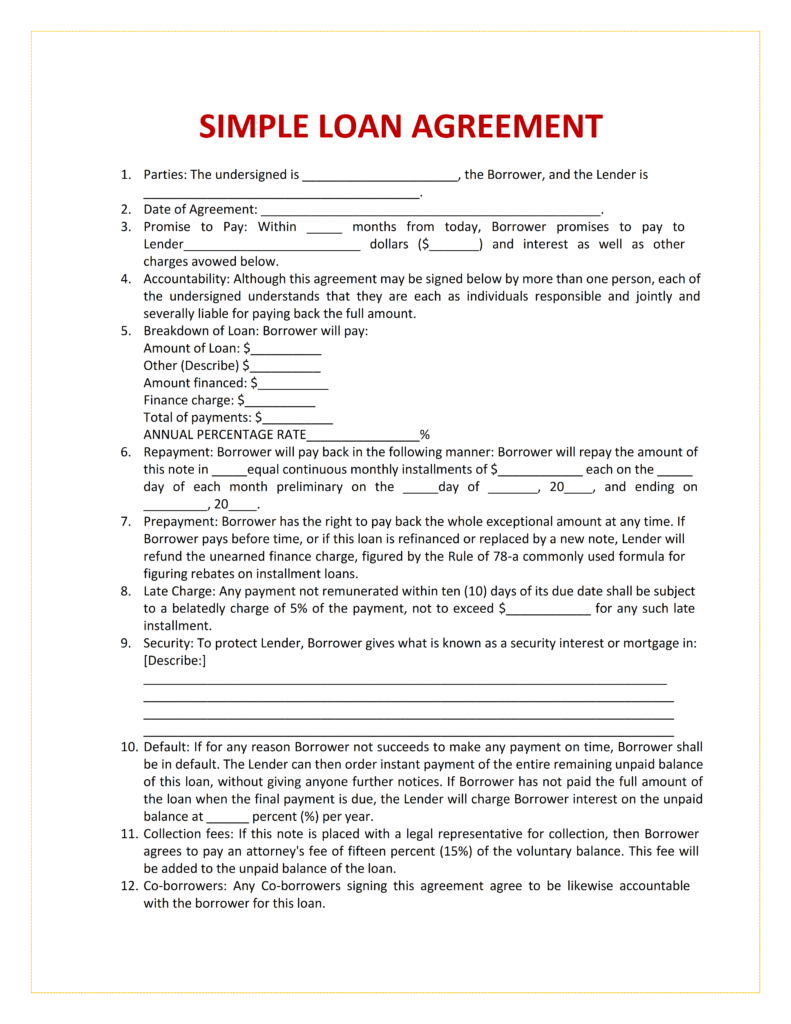

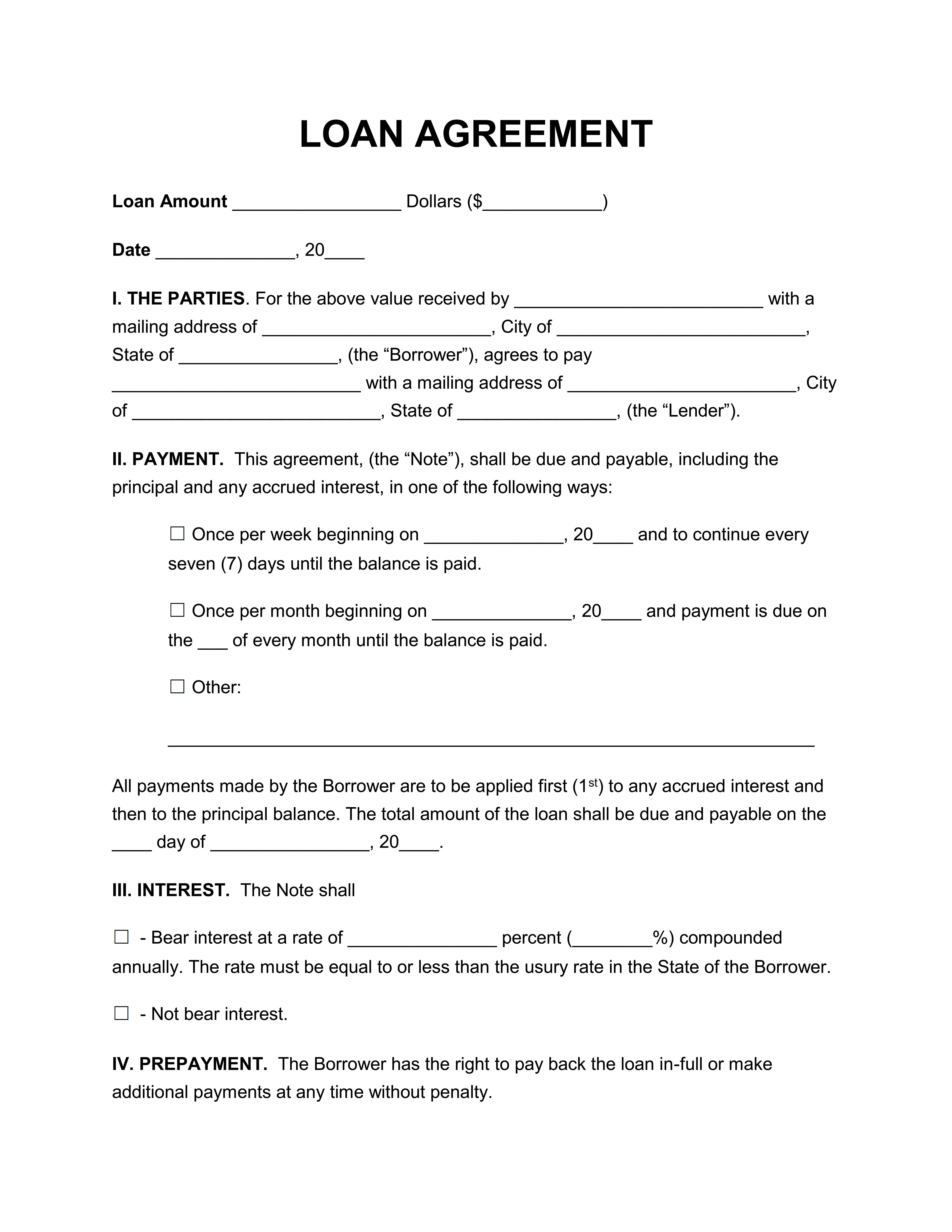

Loan Agreement Template 01

Loan Agreement Template 01

Significance of Family Loan Agreement:

Here is the significance of a family loan agreement:

- When you enter into a family loan agreement, your borrowing history is not considered due to the relationship lender helping you with trust.

- In a family loan agreement lender helps you in many aspects like you can urgehim to postpone or give the show some leniency in payment of debt.

- Family lenders may waive offinterest rates or charge less amount of the rate than the usury rate already specified.

- Since loan procedures are completed in a friendly environment instead of a traditional bank one so there is more flexibility in the terms and conditions.

Things to consider while participating in a family loan agreement:

To design the best and most profitable contract for both parties taking part in the family loan agreement, you need to consider some things. It is almost the same as other traditional loan agreements. It should contain some basic terms like repayment amount, interest rate, and date when the amount will be repaid by the borrower. You must consider the need for a witness to avoid complexities in the future.

Here we will discuss some of the most important elements you need to consider before signing a contract.

1. Reliability of the borrower:

You ought to consider the reliability of the borrower even in the family loan agreement. You should analyze whether the borrower is honest enough that he will return the money. He must have enough credit score that could serve as insecurity that debt will be returned. It is very important to pay attention to these details so that this family loan agreement may not turn into a pitfall for the lender. Even if that borrower fails to meet these conditions you can also help him out of the goodwill.

2. Detailed Agreement:

Once you have decided that you will give your family member a loan, you need to formalize the contract. The contract you have designed must be detailed and meet the demands of the traditional loan agreement. Here are the things you must include in the family loan agreement template.

3. Repayment Schedule:

The repayment schedule has the topmost priority while designing a template. Followings things: Borrower name, Amount to be paid, Date when a contract is signed, Time interval i.e. one year, ten years, etc. for returning borrowed money.

4. Interest:

You also must mention the exact interest rate implied on borrowed money at payment on the due date. Interest can be waived if you want to depend on the financial situation of the family.

Terms and Conditions: You can also include the terms and conditions in the contract. For instance, you can include the penalty amount if the amount is not repaid by the borrower on the due date. Similarly, if the borrowers fail to meet the other conditions like interest; you must have enlisted actions you will take in that case in the contract beforehand. This will be beneficial for both parties.

5. Witness at the time of the signing family loan agreement:

No one can deny the importance of the witnesses. So while you have finalized every other aspect of the contract; the last step is to sign that contract. You should sign the contract in presence of the witnesses. Witnesses must be reliable and of worthy credence. They will play an important role if any complexity arises in the future.

Disadvantages of the Family loan agreement:

Let us discuss some of the disadvantages in the list

- While signing the contract of a family loan you need to take all measures to avoid any problems like if the borrower fails to repay the loan in time, the family relationship will suffer. It will create tension among each other. To avoid such complications you must define terms if one is unable to pay back the money.

- Lenders are most liable to lose if the borrower from the family fails to give back the money. You are not able to retrieve the money and cannot even report it. It is a private matter so you can have more risk of loss. You have no other options but just report it and go through a trial.

- Another pitfall for this case is while you are formulating the terms of payment; you must charge interest and tax rates according to legal laws. If you charge less than your loan may be considered as a gift loan. In the case of gift loans, the only lender is liable to pay tax. So get proper advice and create the best templates for the family loan agreement. To accelerate your process of designing such a template we provide you with the best and most well-designed templates. Check out some of our templates

Just download them; customize them according to your need and the family loan agreement template is ready to go.