f you are initiating a partnership with somebody, a profit-sharing agreement is always the best step taken before collaborating on a project. All the terms and conditions must be enlisted to avoid any complexities in future. It not only minimizes legal risk but also provides a safer hand to the contractor by promising a reasonable share of gains.

But there are things that you need to enlist to create the best revenue-sharing agreement between two parties. To lessen your problem, we provide the best and most well-organized templates for profit-sharing agreements available free to download in word and pdf format.

Let’s know what a profit-sharing agreement is:

What is Profit Sharing Agreement?

Profit-sharing is the financial framework in which enterprises provide the fixed portion of earned profit to their employees in addition to salary. It is the step taken by businesses to provide direct or indirect payment depending on the profit earned by the business. It can also be signed between two entities that will work for some purpose usually a project for some time. Sir Theodore Cooke Taylor was the first person to introduce this concept in his wooden mills during the late 1800s. These plans are predetermined to share gains between employee and company. So this type of agreement in which both entities sign is known as a profit-sharing agreement.

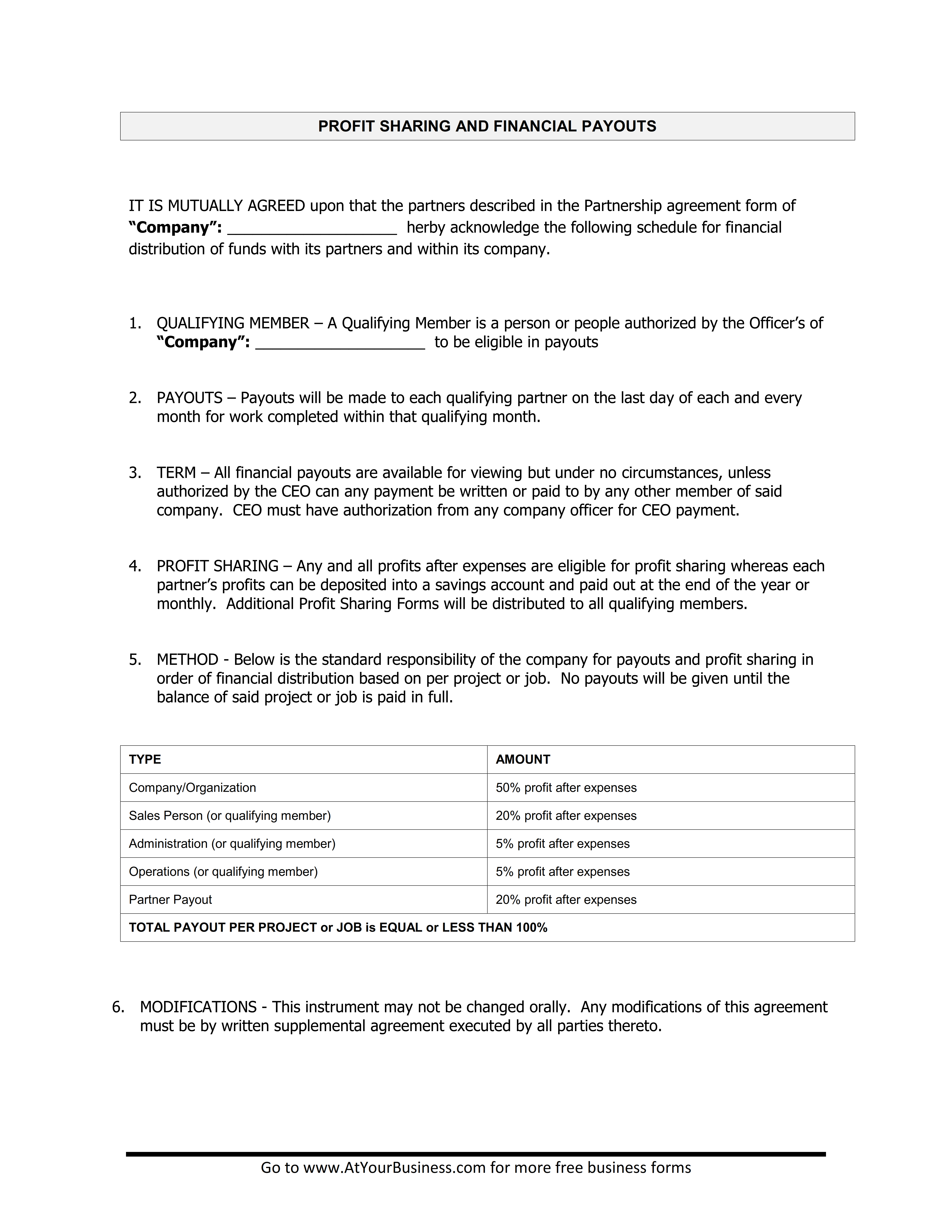

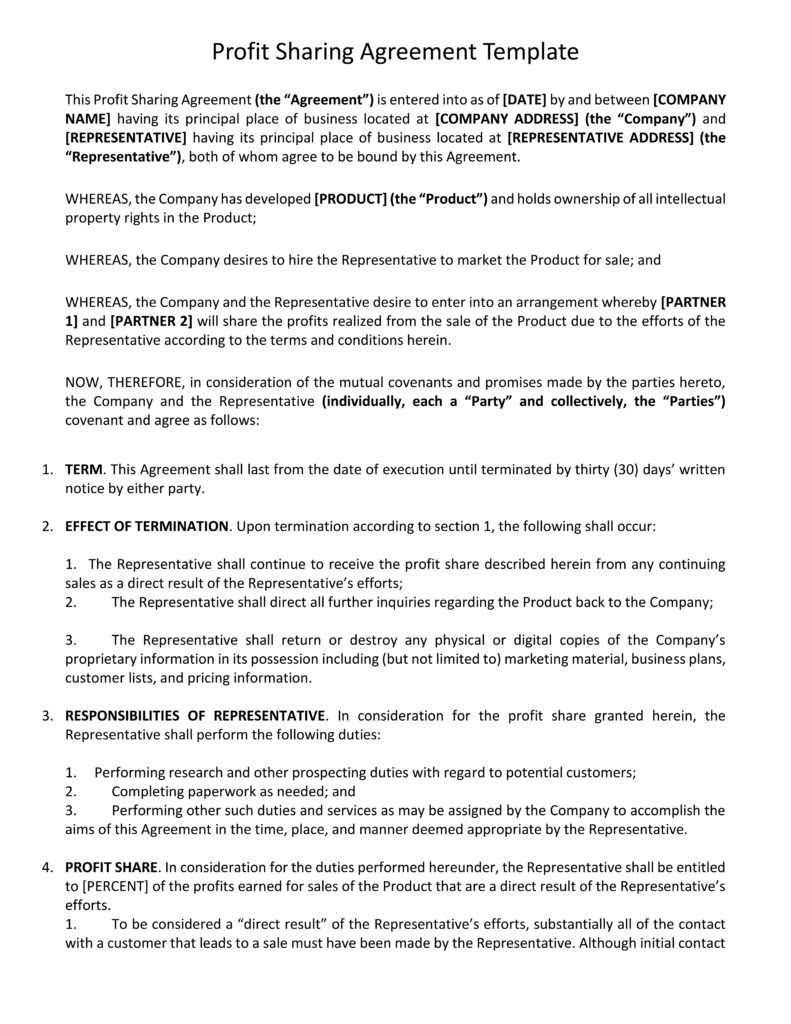

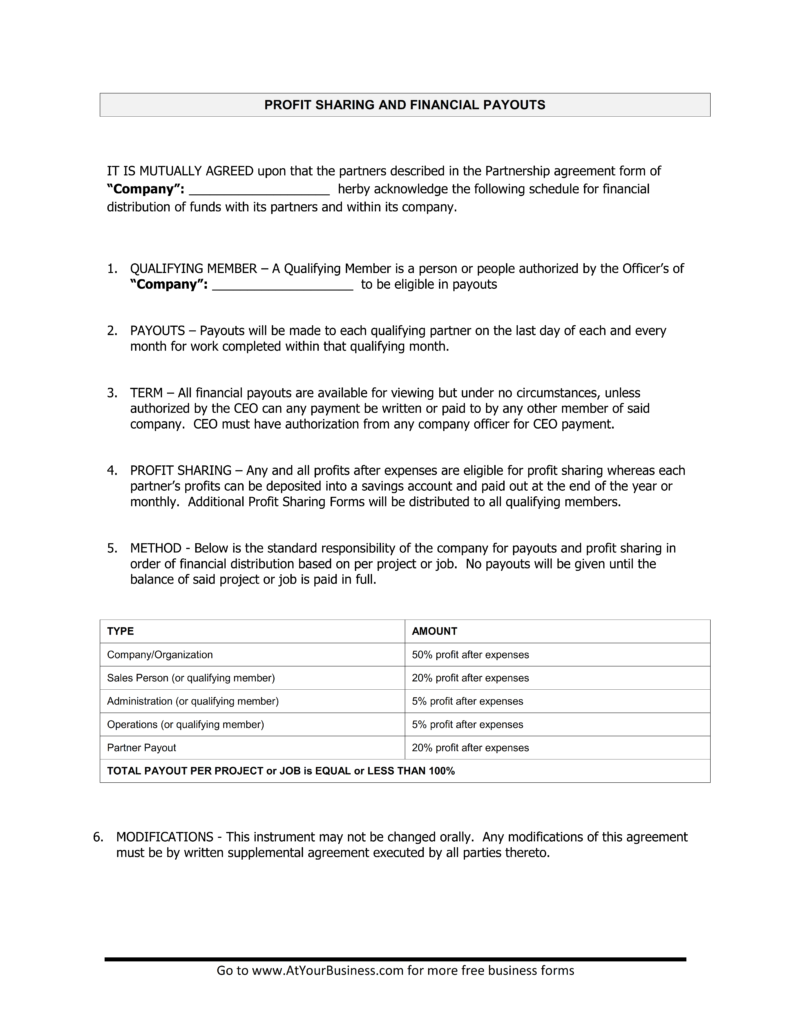

- Profit Sharing Agreement Template 01

- Profit Sharing Agreement Template 02

How does the Profit-Sharing Agreement work?

In Profit Sharing Agreement, the company is known as “Principal” and the employee is referred to as “Agent”. Suppose the ABC Company has signed a profit-sharing agreement with its employee, Taylor. The principal and agent have agreed to share the s(x) value of profit. The ABC Company earns x profit in a certain period. Now according to the agreement Taylor, who is the agent, will receive s(x) amount and ABC Company, who is principal, will receive x – s(x) amount. Profit contribution to employees is made at the end of the fiscal year. At the end of the year, your company has the annual figures of overall profitability of your company. This tends to make a better decision regarding the contribution of annual gain earned.

When a Profit -Sharing Agreement Is Used?

A Profit-Sharing Agreement is used when two parties collaborate either to bring skills or capability in use to earn profit. This is a joint venture between two entities to work together for any project and restricts to form another new company for the same purpose. Once both parties have signed the agreement, they will share the gain earned. This helps to avoid disputes and confusion during work. For instance, a company wants to advertise its items. It enters into a profit-sharing agreement with the share of 80% of profit allotted to the company and 20% to the advertising agent. On the successful launch, that company earned a profit of about 2 million now it is bound to give about 0.4 million to that agent.

Profit-Sharing Agreement and Pension Plan:

In some countries like the United States, a profit-sharing agreement is directly related to pension plans. Instead of sharing profit amount with agents after every fixed timeframe, it is more likely to fix this amount of money in pension after retirement. If an agent or employee becomes ill, suffer any financial problem, or reaches the age limit then this amount allotted to the pension plan will help him to continue his job and he can draw out his money.

Benefits of Profit -Sharing:

- Profit-sharing is beneficial for owners it is not mandatory to pay on every profit made. If you have earned a good amount of profit then you can share the excess amount with your employees.

- Revenue-sharing agreement helps you to avoid payroll taxes and award them to your employees.

- Profit-sharing is an attractive tool to retain employees.

- The retirement plan is the mostengaging. It gives your employees a reasonto stay at your company.

Clauses defined in Profit-Sharing Agreement:

A profit-sharing agreement may include the following clauses:

1. Terms and Conditions:

The profit-participation agreement must include the terms on which both parties either principal or agent has agreed. It may also include the renewal term that encompasses the time period when this agreement shall be renewed. It may also include purpose, responsibilities, expenditures, taxation details.

2. Profit-Sharing:

The revenue-sharing agreement must include the split amount for the gain earned usually in percentages. It also includes the timeframe in which profit will be shared between principal and agent, and when an agent will receive his share.

3. Expiry of Agreement:

Profit-Sharing Agreement must include a clause that defines that according to what circumstances and how the agreement will be dismissed.

4. Clash Resolution between entities:

Both parties may encounter disputes regarding the agreement, so a dispute resolution clause may be included that will bring them together ad solve the matter of dispute between parties. This assures a prolonged contract between them.

5. Confidential Agreement:

The principal and agent should agree that they will keep clauses of the agreement confidential. If the privacy of the agreement is breached the agreement is terminated.

6. Commitments:

There should be terms in the profit-participation agreement that includes that tell what the requirements to pursue collaboration are there. Each entity agrees that it will deliver the best of its skills and abilities.

7. Insurances and Obligations:

In case of any issue during the time of agreement occurs, this clause will provide information that which party is liable for the problem and to what extent has to pay the indemnity.

8. Witness:

The revenue-sharing agreement template must include the space where the witness and both parties can affix their signature. The profit-sharing technique is very beneficial for every business. However, the creation of an effective profit-sharing agreement can be difficult for you. You may want to take assistance from a legal advisor can be costly. Well, here is an easy solution to this problem. Download free revenue-sharing agreement templates available in word, pdf format that will solve this problem in minutes. You can download the template and customize it according to your requirement.