Overdue payment is one of the most difficult situations that every business would face at some point. Dealing with past-due payments may be aggravating for business owners. Fortunately, there are strategies to reduce past-due payments and guarantee that you are reimbursed for your efforts.

You may also use a late payment reminder template and tweak it to create the perfect payment reminder for your specific business. Because it is less expensive, email is the primary technique for delivering payment reminders. Direct mail, on the other hand, has a far greater response rate than email.

What are payment reminder templates?

A payment reminder is a piece of information sent to customers in the form of mail, an email, a document, or any other format to remind them to pay an overdue invoice.

The reminders help customers in repaying the organization, as the cycles above demonstrate that this procedure is not a one-time thing.

Additionally, the payment reminders’ main distinguishing feature is their more welcoming tone. As a result, you can be certain that you will not offend or catch the consumer off guard.

Things to keep in mind while writing Payment reminder templates

As the consumer has already gone through the process of using your services, you have all the information you need to know about how they like to be reached. As a result, it should be simple to identify whether the message should be sent via email or SMS at this point.

The first payment reminder round serves as a warm and respectful reminder to the consumer regarding the upcoming payment. This should also be true for the other cycles. It’s best to go over a list of what should be included in the payment reminder message.

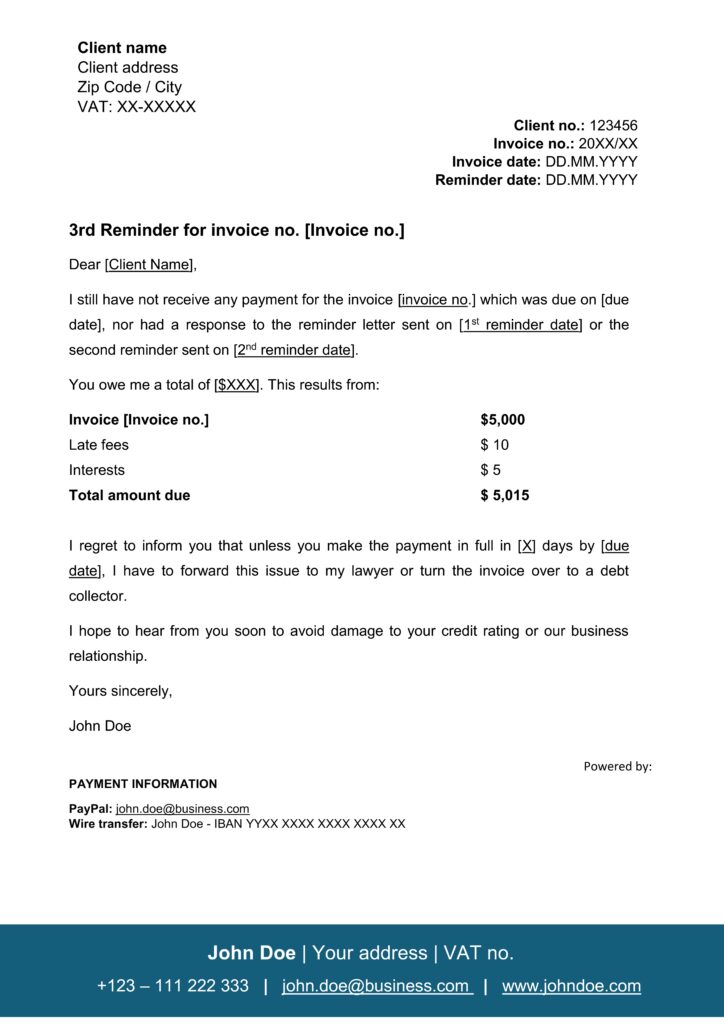

Template 01

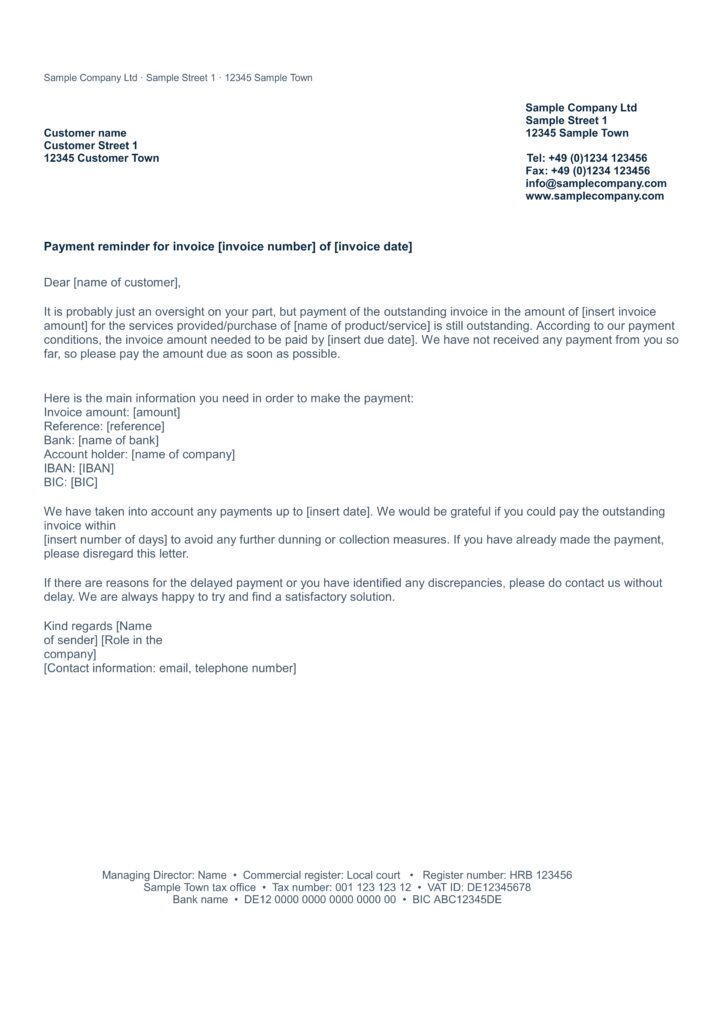

Template 02

The reason you are Contacting

The user should know why you approached them and the message you are trying to convey about the approaching deadline for payment. It should be clear that this is a payment reminder, and the invoices are still unpaid.

Invoice Details

Don’t be vague about what invoice you’re talking about. If that’s the case, include a call-to-action (CTA) and most definitely state the due date and the amount. Repetition and constancy are essential in this message or email.

The agreed Payment terms

Businesses can choose their own payment terms and demand a down payment in advance. As a result, be sure to include the specified terms in your email to your clients.

Outstanding payment issue

Inform the customer of the possible consequences if the payment is not made on time. Customers are more likely to pay on time if the bill is presented in a timely manner.

Friendly tone

It doesn’t matter how difficult it may be for businesses to send out reminders; you should always have a positive and polite tone. As a reminder, don’t be afraid to nudge and grin at the person who hasn’t paid their bill yet. Because it can happen to even the most careful of customers, it’s best to remain upbeat and simply grin about it.

Keep the rules in mind.

Businesses must abide by a set of legal guidelines for reminder content. Before creating the text for the reminder, do some research on the countries where the companies operate and work.

Language

Each piece of information should be tailored to the specific needs of each customer, including the language. Sending an email to a client in their original language increases the probability that they might read and understand your message more quickly.

How to write a past due to payment reminder template?

To make your life easier, use payment reminder templates! They are not, however, obligatory structures that companies must adhere to. You can create templates that are tailored to your business or industry.

Whenever it comes to past-due payment templates, there is no one-size-fits-all. More than anything else, it’s about putting together the appropriate information and delivering this at the right moment. Here are a few suggestions for your template:

- At the perfect time, follow up.

- Invoices should include all relevant information.

- Include all relevant contact information.

- Keep your writing simple and to the point.

- Be warm and polite to the customer.

- Make the reminders automatic for your convenience.

How to attach an invoice to a Text message?

Desautel makes the process a lot simpler. Businesses use a variety of channels to engage with their clients via text message.

SMS, for example, does not allow attachments to be sent.

It is easier to deliver the invoice as a hyperlink and include an automatic SMS reminder for clients who want to receive their invoices by text message.

Creating an automatic setup is a simple step that every business can take, whether it’s for a lot of customers or one at a time, for example, it can contain an attachment so that firms can send their own invoices to customers, but RCS has a few drawbacks on its own. Businesses can’t rely on it because it only works on Android phones and is only available in nine countries.

Viber, WhatsApp, Telegram, Facebook Messenger, and Instagram all allow attachments in text messages.

Invoices can be attached and sent as an attachment by businesses. Check to see if your client is using the channel you selected. A hyperlink that the client gets to see, and download is preferable to sending an attachment that the client might or might not view. SMS has the highest open rate to this day, so make the most of it.

Conclusion:

A lot more people don’t pay attention to payment reminders sent by email. Direct mail, on the other hand, has a much better chance of getting a response, and address verification can make sure it gets there.

When a customer doesn’t pay on time, it’s one of the biggest problems that every company has to deal with at some point or another. It can be difficult for the company to deal with a payment that hasn’t been made on time.

Fortunately, there are ways to make sure that you get paid for your work as soon as possible. It’s time for businesses to use more than one way to remind their customers that they owe them money. Direct mail could be the perfect way to send payment reminders.